KOPER – Luka Koper announced the semester results and a comparative table with the ports of Trieste and Venice. The Slovenian port grows beyond expectations and aims to exceed one million Teu on an annual basis after paying dividends to shareholders.

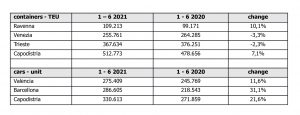

As happened at the nearby port of Trieste, especially as regards containers, the Covid-19 pandemic did not leave great marks to the port of Koper. The handling of 512,773 Teu is 7% higher than in the first half of 2020. On the other hand, car traffic rises by as much as 22%, with a total of 330,613 units.

In the first half of 2021, the overall movement of goods grew by 2% to 10.4 million tons. However, both liquid and solid bulk are falling. Luka Koper, the port management company, explains this by a reduction in the consumption of jet fuel in the aviation industry (and thus a lower amount of petroleum products handled at the port) and a slight decrease in coal production, as a result of the decarbonization trend across Europe.

A press release by Luka Koper also reports a comparative table examining other ports, both in terms of containers and car traffic. In particular, it is noted that the two Italian ports of the Upper Adriatic report a slight decrease in traffic.

Finally, in the press release, Luka Koper also examines growth from a financial point of view.

Operating profit (EBIT) stood at € 17.7 million, an increase of 3%, mainly due to higher net sales revenues, with a positive effect on the Group’s net profit, which stood at 15.4 million euros, again in the period January-June 2021, 2% more than in the same period last year.

In the first half of the year, the Port of Koper completed some significant investments: a new garage for cars, a new entrance for trucks, the extension of the quay of the container terminal and the purchase of equipment for the terminal itself. Allocations reached 30 million euros, 84% more than in the first half of 2020.

The company estimates that it will reach the business indicators planned for 2021. The assessment is based on forecasts of economic growth in key markets and the fact that increasing vaccinations against Covid-19 will bring less impact on the economy and commodity flows.